Descriptions

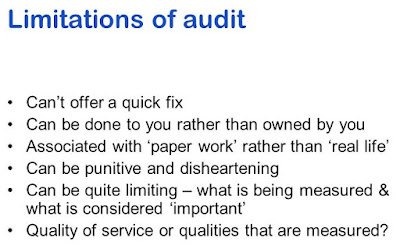

- Limitation of auditing:

- though auditing is a very useful technique, its following limitations must be kept n mind:

(1) Not useful for small Business Units: In small business unit, the owner himself is the manager and accountant. His business transactions are limited and so he can write his own accounts. Hence, for him auditing is of no use.

(2) Lack of Assurance of Completely Correct Accounts: Sometimes, even audited accounts can not guarantee the complete correctness of accounts. In very big business units, it is not possible to check each and every transaction

(3) Possibility of Errors and Frauds : The auditor has to be reasonably careful in auditing accounts. So naturally he cannot audit accounts with the assumption that there is some error or fraud. When employees to commit fraud, even the auditor cannot detect i

(4) All Information and Explanation not Received While auditing accounts, the auditor has to ask for mny information and explanation from the client. But all of them are not received from all cients and so the audit cannot together come guarantee correctness

(5) Dependence on Experts' Opinions During the audit work, the auditor has to depend upon experts' certificates in many respects. e.g. value of closing stock, value of machinery etc. But such certificates are not always true.

(6) Post-mortem Examination of Figures : An audit is only post-mortem examination of figures. It means the accounts are audited only after events have taken place. So s not of much use. However it can be useful for future.

(7) Auditor's Prejudice Generally, the auditor's projudices in his audit work. Though he must remain neutra, he cannot do so, due to so : are reflected : many reasons

(8) Influence of Managerial Personnel In fact, it is the auditor's duty to protect the interest of shareholders. But in practice, he has to work with the managerial personnel. Really speaking, the management decides who is to be appointed as auditor, Hence, under the pressure and influence of management the auditor does not disclose all the deficiences which have come to his notice.

(9) Disturbance in Regular Work During the audit work, the regular business routine is disturbed. The auditor frequently asks for explanations information, vouchers, statements etc. This leads to waste of time of the staff and it will lead to reduced efficiency of the staff.

(10) Expensive : The audit has to be entrusted to the expert auditor who is a chartered accountant and naturally his fees are bound to be high, so small business units cannot afford i In such cases, the benefits from audit will be less than the costs involved.

THANKS FOR READ MY BLOG.

ALSO YOU CAN FOLLOW ME ON BLOG.

AND DO NOT FORGET TO COMMENT SECTION.

Ok sir thanks for this information

ReplyDelete